Compound Interest Calculator: Investment Growth and Savings

Wondering how your money can grow over time? This free compound interest calculator makes it simple. Just enter your savings, interest rate, and how often you add money, and you’ll see how your money slowly beings working for you.

Modify values and click Calculate

Results & Contributions vs Interest

Accumulation Schedule

Schedule

| Year | Contribution | Interest | Ending balance |

|---|

| Month | Contribution | Interest | Ending balance |

|---|

What is Compound Interest?

Compound interest is the process where the money you save or invest not only earns interest on the original amount, but also begins to earn interest on the interest that has already been added. Over time, this cycle of growth builds on itself, stacking over time, and turning small amounts of cash into a much larger savings.

A compound interest calculator will show you how contributions, time, and growth rates work together. This makes it easier to see how consistent saving habits can move you closer to financial freedom. By reinvesting the interest instead of taking it out, your balance grows at a faster pace than it would with simple interest, where only the starting amount earns returns.

How to Calculate Your Interest

The idea behind compound interest is that your money grows by earning interest on both the starting amount and on the interest that keeps adding up. To calculate it, you can use the compound interest formula or a compound interest calculator that does the math for you. Understanding the steps makes it easier to see where your growth comes from.

The formula looks like this:

A = P (1 + r/n)nt

Where:

P = the starting amount (principal)

r = annual interest rate (decimal)

n = how many times interest compounds each year

t = number of years

A = the final amount after compounding

Here’s how to calculate it step by step:

- Start with your principal. This is the money you initially deposit or invest.

- Find your interest rate. Convert the annual percentage rate into a decimal. For example, 5% becomes 0.05.

- Decide how often it compounds. Common options are yearly, quarterly, monthly, or daily.

- Multiply by time. Figure out how many years your money will stay invested or saved.

- Apply the formula. Plug the numbers into the compound interest formula, or use a calculator to see the final amount.

This process shows not only how much interest you earn but also how much faster your savings grow when you let compounding work for you. Even small increases in contributions or interest rates can make a big difference over time.

Compound Interest Growth Example

Here’s how your money could grow over ten years with a $2,000 starting balance, 5% annual interest (monthly compounding), and different monthly contributions:

| Monthly Contribution | Balance After 10 Years |

|---|---|

| $0 | $3,280 |

| $50 | $9,800 |

| $300 | $41,000 |

Tips to Maximize Compound Interest

One of the most effective ways to see compound interest in action is by making regular contributions. Say you begin with $2,000 in an account earning 5% interest compounded monthly. If you don’t add anything, after ten years your balance would be about $3,280. Add just $50 per month and your balance grows to around $9,800. Increase that monthly contribution to $300, and after the same ten years you would have about $41,000. The leap shows how steady deposits dramatically change the outcome.

It also helps to automate your savings. Setting up a recurring transfer or allocating part of each paycheck directly into your account makes compounding automatic. This habit keeps you on track without needing constant reminders, ensuring your savings keep building in the background.

Getting an early start is another advantage. Time is one of the most powerful factors in compounding, because the longer your money sits and grows, the greater the effect of interest-on-interest. Even small amounts saved today can make a meaningful difference decades down the line. A compound interest calculator is a simple way to experiment with timelines and see how quickly your savings can expand.

Finally, pay attention to the account you choose. An account with a competitive rate will grow your balance far faster than one that pays very little interest. Over many years, that difference compounds into thousands of dollars that could either be working for you or sitting idle. Choosing wisely helps you get the most out of every dollar you save.

Where to Put Your Money to Get the Best Return

Finding the right place for your money depends on your goals, your time frame, and how much risk you are willing to take. Some people focus on short-term security, while others want long-term growth that moves them closer to financial freedom. No single option works for everyone, but there are several proven places where money can grow steadily when used wisely.

High-Yield Savings Accounts

If you want low risk and easy access to your cash, a high-yield savings account is a strong choice. The interest rates are far better than those of a regular savings account, which means your money earns more while still staying liquid. This option works well for emergency funds or short-term goals where safety is a priority.

Certificates of Deposit and Bonds

For people who do not need immediate access to their money, certificates of deposit or government bonds can provide predictable returns. They usually pay higher interest than a savings account, though you may need to lock in your funds for a set period. These options are reliable for steady growth without taking on major risk.

Retirement Accounts

If your focus is long-term wealth building, tax-advantaged retirement accounts such as 401(k)s or IRAs allow your money to grow through investments in stocks, bonds, and index funds. The growth is amplified by compounding over decades, which is where a compound interest calculator can help you see the potential outcomes. Starting early and contributing consistently makes a dramatic difference.

Investing in the Market

Stocks, index funds, and exchange-traded funds offer some of the highest returns over time. These investments come with more volatility, but they reward patience. By reinvesting dividends and holding through market cycles, your portfolio benefits from compound interest as earnings generate more earnings. For long-term goals, this approach can be one of the most powerful paths toward financial freedom.

Mixing Safety and Growth

Many people find that the best results come from combining different types of accounts. A portion of money can stay in a high-yield savings account for stability, while the rest is invested for higher returns. Using a calculator to compare different scenarios helps you visualize how contributions and interest interact across accounts, making it easier to balance risk and reward.

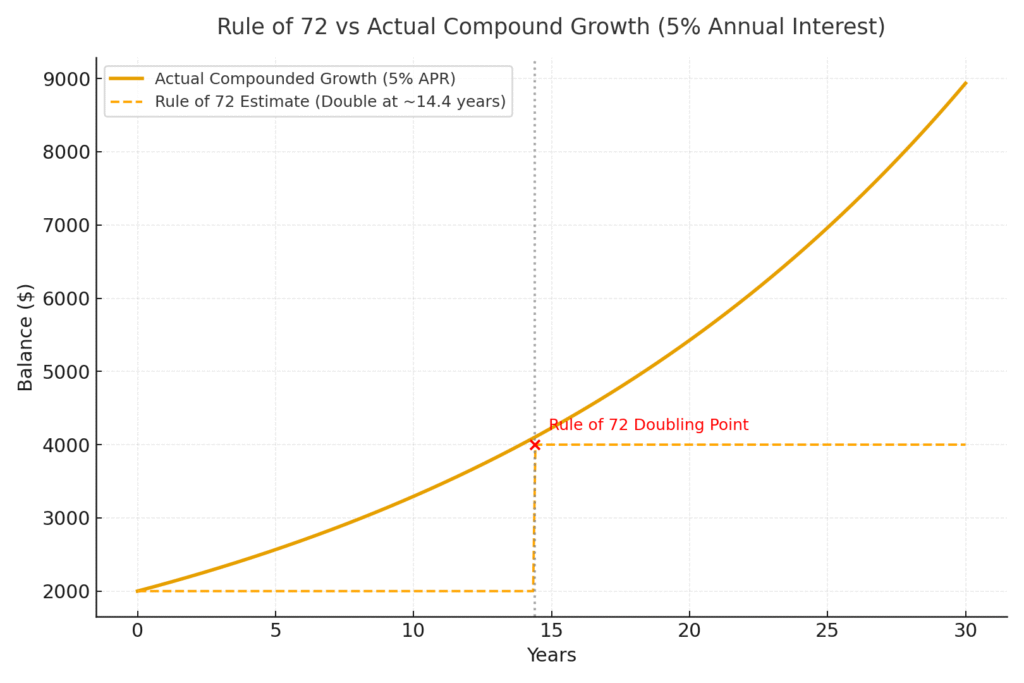

What is the Rule of 72?

The Rule of 72 is a quick way to estimate how long it takes for money to double at a given rate of return. Instead of running full calculations, you simply divide 72 by the annual interest rate. The result gives you the approximate number of years until your savings grow to twice their starting value. It’s not exact, but it’s fast, easy, and surprisingly accurate in most cases.

How the Rule of 72 Works

For example, if your account earns 5% per year, divide 72 by 5. The answer is about 14.4, meaning your balance should double in just over fourteen years. This makes it clear how even small differences in interest rates can change your growth over time. A higher rate means fewer years before doubling, while a lower rate takes longer.

Example: Rule of 72 vs. Exact Formula

Imagine you start with $2,000 in an account that earns 5% interest, compounded annually. Using the Rule of 72, you expect your balance to double in about 14.4 years. The exact compound interest formula shows your money would reach roughly $4,050 in that time, which is very close to the shortcut. The small difference comes from rounding and the fact that compounding frequency affects the exact outcome.

When to Use the Rule

The Rule of 72 is most helpful when you need a fast mental estimate. It will not account for taxes, fees, or monthly contributions, which is where a compound interest calculator gives a clearer picture. Still, knowing how to apply this shortcut can help you quickly understand the power of compounding and how it can move you closer to financial freedom over time.

FAQ – Frequently Asked Questions

How often should interest be compounded?

Compounding frequency refers to how many times per year interest gets added to the account (monthly, quarterly, daily, etc.). The more frequently the interest is applied, the faster your balance grows. For example, $1,000 at a 5% rate compounds more growth if interest is added monthly instead of just annually. Always check the account’s compounding schedule when comparing savings options.

What is the difference between simple interest and compound interest?

Simple interest is calculated only on the original principal. With compound interest, you earn interest on both the principal and the accumulated interest. Over time, compound interest leads to a much larger balance, especially when the interest is compounded frequently, or when contributions are reinvested.

Does adding money regularly increase growth significantly?

Yes. Even small recurring deposits can change the outcome drastically. When you add to your balance regularly, each deposit begins earning interest. Over many years, these contributions, plus the interest they generate, build up. This habit of consistent deposits is often more powerful than waiting for high rates alone.

Can inflation reduce your returns?

Absolutely. Inflation eats away at purchasing power. Even if your balance is growing, if prices rise faster than your interest, the real value of those funds is lower. When planning long periods, it helps to estimate what your ending balance will buy in future dollars rather than just looking at the nominal number.

Are there penalties or fees that reduce growth?

Yes. Account fees, early withdrawal penalties, or minimum balance requirements can all cut into your gains. Some accounts reduce rates if balances fall below thresholds. Others may charge monthly service fees. These costs may seem small but over time they can significantly reduce net growth.

How much does interest rate affect doubling time?

The interest rate has a large effect. A higher rate means your money doubles faster. For example, at 4% interest it might take about 18 years for your balance to double, but at 8% it takes around 9 years. Even a small change in rate can lead to big differences over long periods.

What happens if I withdraw earnings regularly?

Taking out interest or earnings reduces the compounding effect. When you withdraw instead of letting interest stay in the account, future interest is calculated on a smaller base. Over time, withdrawals can drastically slow or even stall growth depending on frequency and amount.

How do I choose between different savings or investment options?

Compare rate of return, compounding frequency, fees, penalties, and liquidity. Also consider risk tolerance and timeframe. What matters more: rate, frequency, or how often you add money? Use examples or tools to simulate options. Look for accounts or products that align with your goals and provide good after-cost value.

Conclusion

In conclusion, steady progress beats short bursts of effort. When you commit to regular contributions, even in small amounts, the growth adds up over time. What looks modest in the beginning can grow significant if you stay consistent and allow time to work in your favor.

Rather than focusing on quick wins, think about the long-term picture and where you’ll be in 10-20 years from now. Every deposit builds on the last, and the results often feel larger than expected once the years add up. This process rewards patience and discipline more than luck or timing.

By keeping your habits simple and repeatable, you make financial growth feel less overwhelming and more achievable. The journey is not about doing everything perfectly but about staying on track and letting steady choices compound into meaningful results.

Read how to build an emergency fund next, or if you’re financially struggling right now, learn how to budget when you’re broke in order to start saving today.