How to Build an Emergency Fund With A Tight Budget

Learn how to build an emergency fund that fits your budget, eases financial stress, and gives you a clear starter goal that you can begin growing today.

Everything I share is backed by credible research, verified sources, and or my own personal experiences. Im not a therapist or financial advisor. I’m someone who’s lived through both sides of poverty and recovery. Compound Choices is made to work alongside therapists & financial advisers, not to replace them.

Most of us know we should be saving, but when your bills keep stacking up and your paycheck barely covers the basics, saving anything can feel out of reach. The stress of money, and that constant “what if something goes wrong?” loop in our heads can wear us down fast. This can feel even more intense when you have no safety net to fall back on.

This guide is here to make savings feel doable, even if you have a tight budget. You’ll learn how to start small, and slowly, gain a sense of control back. Let’s talk about how much you should to aim for, why even setting up a small starter fund can ease your financial stress, and the simple steps that make saving anything realistic when money is tight.

We’ll go through setting up an emergency fund that protects you from surprises and gives you some peace of mind, instead of constant worry.

Let’s begin!

Why an Emergency Fund Matters Right Now

You’re not imagining the squeeze. Many households still feel stretched as rent, groceries, and everyday costs keep budgets tight.

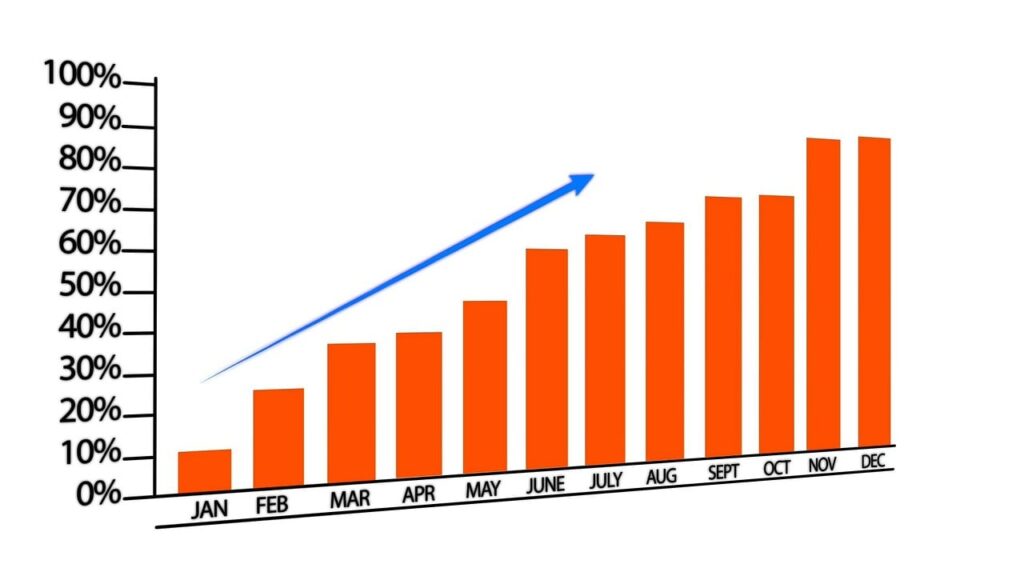

Only around 63% of adults say they could cover a $400 surprise with cash or its equivalent, a figure that has stayed stubbornly flat for years. That means the majority of people still face huge financial stress when even a small bill hits.

A small safety net can change your day-to-day experiences. When a clinic copay or a vehicle bill appears, cash on hand keeps you out of a high-interest debt and will prevent a short bill from turning into a longer problem.

About 67% of Americans are living paycheck to paycheck in 2025, which makes a savings plan even more urgent and more realistic than ever. Learning how to build an emergency fund gives you a buffer that turns those scary surprises into smaller manageable setbacks.

Money and mental health travel together on the same road. A report, Stress in America, found the economy is a significant source of stress for most adults, which explains why even a small safety net can help you breathe easier at the end of the day.

That first layer of savings also lowers financial stress during months when costs can spike.

How to Build an Emergency Fund Step by Step

This section shows you how to build an emergency fund with small, steady choices that stack over time. This makes saving money easier, which gives your future more protection.

Start with a small safety goal you can reach fast

Pick a target you can hit in 30 to 60 days. Aiming for $250 or $500 is a strong first step. If that feels far, start at $100 and slowly climb that number up.

Even a modest cushion is linked to better well-being, and that $2,000 or maybe half of your month’s expenses mark a meaningful early safety net for you. If you’re figuring out how to build an emergency fund on a tight schedule, try a 30-day sprint with tiny daily deposits.

Compound tip: Start by setting aside just a few bucks from each paycheck in a separate account so it’s out of sight and has a chance to grow.

Choosing the right account to keep your fund safe and separate

Now, keep this money in a separate savings account at an FDIC-insured bank or an NCUA-insured credit union. Separation helps you see progress and resist spending it on everyday wants.

$250,000 per depositor, per insured bank, per ownership category; NCUA mirrors that limit for federally insured credit unions. You can compare options and open up an easy-access, high-yield savings account.

Afterwards, ask yourself “how much should I have in an emergency fund?”, so that the target guides where you park the cash.

Simple daily habits that make saving automatic

In most cases, automation beats willpower. You can setup a transfer on payday so that your money moves before it blends into your spending. If your income varies, automate a small base amount and top it off extra money comes through.

Small, regular contributions placed in a separate, liquid account is a stable way to setup your safety net. Automating small contributions can also reduces your money anxiety because the decision is already set in stone for you.

How Much Should I Have in an Emergency Fund?

There’s no universal number. Your ideal target depends on job stability, your household size, health, and who depends on your paycheck. Most people start by asking, “how much should I have in an emergency fund”, then refining the number to fit their life.

The difference between a starter fund and a full fund

A starter fund can protect you from the most common bumps. Think $500 to $2,000. It covers a tow, a clinic visit, or a surprise bill without panic. A full fund is measured in months of essential expenses.

You should typically aim to save three to six months worth of your paycheck, but some families prefer more if their income is unstable. A large percentage of Americans do not have three months saved and nearly one in four report having no emergency savings, which is why a reachable starter goal matters so much.

If you’ve wonder “is $1,000 enough for a starter emergency fund”, it’s absolutely better than nothing.

Percentage guidelines that work for most households

Five percent of your take-home pay is a realistic starting point for many to begin saving. When you reach your starter goal, revisit the plan. After a raise or when you’ve paid off a debt, increase that percent or set a time-bound target like one month of essentials within nine months.

A simple rule of thumb, ask yourself, “how much should I have in an emergency fund right now”, and reset the target as your situation changes in time.

When to adjust your savings target based on life changes

Update your numbers after a job change, a move, a new child, or a health shift. If you freelance or rely on tips, lean higher because pay is uneven. If your household has two steady paychecks and strong benefits, the lower end of the range may be enough.

The 400-dollar shock data is a useful reminder to revisit the plan so progress never stalls.

Emergency Fund for Low Income Households

Saving can feel harder when every dollar of yours already has a job. However, you can still do it by stripping friction and protecting small your wins so that they compound in time. This section gives you an emergency fund for low income path that respects your tight budgets.

Building a fund when every dollar feels tight

You should start with the smallest automatic transfer that does not break your week. Five dollars works. Ten dollars works. The consistency matters more than the numbers. When a rebate, tax refund, or side-gig payment arrives, move a slice of it into your savings on the same day.

Employers are also helping. Employer-sponsored emergency-savings accounts linked to payroll are gaining traction, with auto-enrollment and small company contributions becoming more common. This is the heart of having an emergency fund for low income plan that can removes stressful barriers.

Compound tip: set a weekly “maximum swipe” rule for nonessential buys. If something costs more than your limit, wait 24 hours. Pausing keeps early progress from leaking away.

Creative ways to find extra savings without cutting essentials

Switch to a lower-cost phone plan or pause a subscription for 90 days. The same day you make the change, set up an automatic transfer for the exact amount you freed so it doesn’t slip into daily spending.

With many households still living paycheck to paycheck, small changes like these are realistic and powerful, and slowly compound over time. They start building your emergency fund right away, even on a low income, without cutting into essentials.

Emergency fund for low income step by step

If you want a clear map, follow step by step emergency fund for low income ladder. Mark five visible milestones: $100, $250, $500, $750, $1,000. Celebrate each one with a free reward like a library movie night or a walk with a friend.

Once you cross $1,000, raise the auto-transfer by a few bucks if your budget allows. It’s recommended to keep this money liquid and separate to preserve it for true emergencies, which is key to making your ladder work.

How an Emergency Fund Reduces Financial Stress

Stress thrives on uncertainty. A cash buffer can’t control prices or surprise bills that hit you, but it can reduce how often you’ll have a chaotic month.

The economy remains a top stressor for most adults, which lines up with what many families feel. Seeing the balance grow, even slowly, is one of the most reliable ways to ease financial stress at home.

Having more cash in your savings account equals fewer missed bills and fewer downstream problems. Fewer late fees means less worry about calls or notices, and more control for the rest of your life. Pair a weekly check-in with a small automatic deposit and you’ll feel the shift as the habit forms.

Learning how to build an emergency fund is not only a finance project, but it’s also a mental health project that pays you back with peace of mind over time.

Here’s a quick practice that you can try this week. on Friday, open your savings app, take three slow breaths, and read the balance out loud to yourself. That two-minute ritual pairs a calming cue with a money action which gradually reduces your financial stress tied to checking balances.

Managing Money Anxiety While You Save

Worrying about the future so often can block action, like a deer in headlights. Money anxiety often shows up as avoidance, doom scrolling, or a knot in your stomach before you open the app. Treat your worries as a signal to shrink the task at hand.

Signs that money anxiety is holding you back

If you delay small tasks like moving $10 or avoid looking at your balances, you’re not the only one. Many adults feel anxious about finances and the wider economy. Name the money anxiety when it shows up, then take one tiny action so it loses power over you.

Simple coping strategies to stay consistent with saving

Create a when-then rule. When your paycheck lands, then $10 moves to savings. Keep the note where you see it. If you feel the spiking rush, pause, inhale slowly, hold for a few seconds, and exhale a little longer than when you inhaled. Then tap transfer.

Over time, that consistent action shrinks money anxiety and builds your confidence back up.

When to seek extra support from professionals or resources

If anxiety blocks daily life or sleep, talk with a licensed mental health professional. Therapy treats the fear cycle and gives you tools that stick. If debt collectors are contacting you, a nonprofit credit counselor can explain practical options. Keep your savings habit alive with tiny deposits while you take care of your health.

Common Questions That Help You Decide Faster

Is $1,000 enough for a starter emergency fund?

Many people ask “is $1,000 enough for a starter emergency fund?” Honestly, it’s a solid early milestone when you’re starting from zero.

Many common surprises cost a few hundred bucks, so $1,000 can cover a tow, or a clinic visit and a copay. This isn’t your finish line though. Think of it as a point on the way to one month of essential expenses, then to several months. Many households still lack any cushion, which is why a reachable milestone is so important to have for anyone.

If you keep asking “how much should I have in an emergency fund?”, the real answer is “enough to cover your life today, then more as your life changes.”

Where should I keep the money so it stays safe and available?

Use a separate savings account at an insured bank or credit union. FDIC coverage applies at banks and NCUA coverage applies at federally insured credit unions.

Both insure $250,000 per depositor in the relevant ownership category. That setup keeps the money protected and easy to access when you need it.

How can I speed this up if I am on a tight budget?

Capture gains you’re already creating. If you’re canceling a subscription, dropping a phone plan, or getting a one-time rebate, you should then set an automatic transfer for the freed amount of cash that same day.

Workplace programs that link savings to payroll are growing and some include small employer contributions that accelerate progress without adding stress. Follow this emergency fund for low income step by step until the habit sticks.

Conclusion

You now have a practical map for how to build an emergency fund that fits your life. Start with a reachable starter goal, place the money in a separate insured account, and automate transfers so progress continues whether or not you feel motivated.

As milestones land, adjust the target, revise, and keep a weekly check-in to maintain your momentum. If your employer offers a payroll-linked program, consider enrolling. With steady deposits, you’ll master how to build an emergency fund and turn today’s effort into tomorrow’s breathing room.

A small pillowy cushion will reduce your financial stress, eases your decisions, and keep routine surprises from making your month miserable. Many people still lack three months of expenses and a majority live paycheck to paycheck.

Each small deposit you make today chips away at money anxiety and builds practical confidence for the road ahead. You’re building stability one smart choice at a time, which over time compounds into stress free living.

Read the budgeting guide next, or try the free compound interest calculator to see how your money can start growing today.

Sources and further reading

- Federal Reserve SHED (2025): Share of adults who could cover a $400 emergency with cash or equivalent. (federalreserve.gov)

- APA, Stress in America 2024: The economy is a significant source of stress for most adults. (APA)

- CFPB, An essential guide to building an emergency fund (2024): How to start, automate, and protect savings. (Consumer Financial Protection Bureau)

- FDIC, Your Insured Deposits / Deposits at a Glance (2024): $250,000 per depositor, per insured bank, per ownership category. (FDIC)

- NCUA, Share Insurance Coverage (2025) + Brochure: $250,000 coverage at federally insured credit unions. (NCUA)

- Vanguard (2025): Emergency savings and financial well-being; $2,000 or half a month as an early buffer. (Vanguard)

- Bankrate (2025): Annual Emergency Savings Report; many households lack three months and 24% have none. (Bankrate)

- MarketWatch (2025): Employer-sponsored emergency-savings accounts and auto-enrollment growth. (MarketWatch)

- Investopedia (2025): 67% living paycheck to paycheck; context on rising costs. (Investopedia)

FAQ – Frequently Asked Questions

How can I build an emergency fund if money is tight?

Start small by saving $5 or $10 from each paycheck in a separate account and add windfalls like refunds or side income. Over time, these small deposits create steady progress.

How much should I have in an emergency fund?

A starter goal of $500 to $1,000 protects you from everyday surprises, while the long-term aim is three to six months of essential expenses.

Is $1,000 enough for a starter emergency fund?

Yes, $1,000 is a strong first milestone because it covers many common emergencies. Once you reach it, keep saving toward several months of expenses for more security.

What is an emergency fund for low income step by step plan?

An emergency fund for low income step by step works by setting small milestones like $100, $250, $500, and $1,000, using automatic transfers to climb each stage.

Can an emergency fund reduce money anxiety and financial stress?

Even a small savings cushion can ease money anxiety and financial stress because it gives you a sense of control when unexpected bills arrive.

Continue reading

Does GAP Insurance Cover Hail Damage? Repairs vs Total Loss

The quick answer: No, GAP insurance doesn’t pay for hail repairs; it only covers your loan shortfall if the car is totaled. There could be exceptions though.

How Much Debt to File Bankruptcy? What You Need To Consider

Bankruptcy is designed to protect you, not punish you. If you’re wondering how much debt to file bankruptcy, there’s no legal minimum.

12 of the Best Jobs for People With Anxiety That Pay Well

Here are 12 flexible careers that could possibly reduce your stress and anxiety while earning reliable income.

Hail Damage Car and Debt: Costly Mistakes To Avoid

Learn how hail damage to your vehicle could be a very sudden costly mistake if not handled properly.

17 Quick Ways to Make Money When You’re Broke & Stressed

If you’re stressed out from being broke, and having little savings, these 17 side hustles could help you begin earning cash within a few days of starting.

Is National Debt Relief Legit? Everything You Need To Know

Is National Debt Relief legit? Here are the facts, risks, and benefits to help you understand your options for managing debt and quickly finding relief.

How to Build an Emergency Fund With A Tight Budget

Learn how to build an emergency fund that fits your budget, eases financial stress, and gives you a clear starter goal that you can begin growing today.

Strategies On How To Budget When You’re Broke

Learn how to budget when you’re broke with solid plans, paycheck mapping, quick cuts, and a starter emergency fund to reduce money stress.